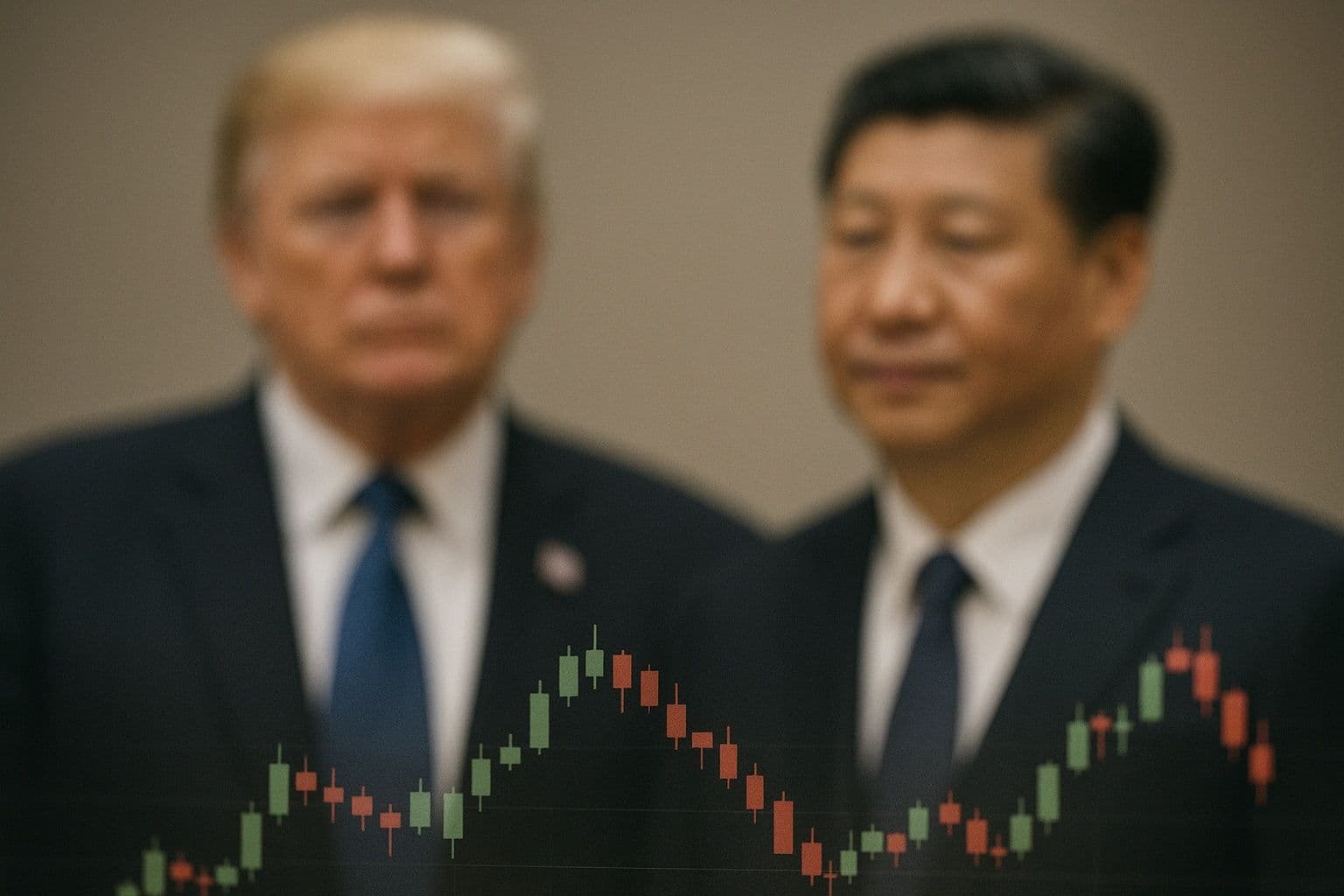

Global markets are on high alert as President Donald Trump and Chinese President Xi Jinping prepare for a pivotal meeting that could reshape economic and geopolitical landscapes. The discussion is expected to cover trade, economic cooperation, and security, creating a wave of anticipation across equities, commodities, and digital assets. Crypto traders are paying particularly close attention, with many believing that even modest signs of improved relations could spark a much-needed upswing for risk assets.

The upcoming summit is being viewed by market strategists as a critical reset moment. For several years, ongoing friction between Washington and Beijing has cast a shadow over global growth projections and fueled market volatility. Because cryptocurrencies often act as a barometer for investor risk appetite, assets like Bitcoin have frequently reacted to major geopolitical headlines. A softer tone between the two economic superpowers could create an environment where traders feel more confident taking on speculative positions.

A Chance for Markets to Rebalance

The possibility of a thaw in US-China relations comes as investors are desperately searching for clear direction. Lingering concerns about an economic slowdown in Europe, uncertainty over future Federal Reserve interest rate decisions, and a mixed corporate earnings season have left many traders on the sidelines. Analysts suggest that a constructive dialogue between Trump and Xi could remove a significant layer of macroeconomic pressure, encouraging capital to flow back into the market.

Historically, even brief pauses in US-China tensions have led to measurable upticks in market confidence. Equity benchmarks have tended to climb during periods of diplomatic progress, with Bitcoin often following suit. The current environment feels similar, as the crypto market attempts to find its footing after a period of sharp liquidations and directionless trading. A senior analyst from a global financial research firm emphasized that any signal of improving global trade conditions could quickly spill over into digital assets by reducing the perceived risk of a severe economic downturn.

Why Crypto Is So Sensitive to Diplomacy

Bitcoin and other major cryptocurrencies are highly sensitive to global macro trends because they are considered high-beta assets. When geopolitical tensions rise, investors typically rotate capital into safer, defensive assets like bonds or gold. On the other hand, when tensions ease, risk tolerance increases, liquidity expands, and speculative assets like crypto benefit from renewed investor interest.

A meeting that signals cooperation could trigger a significant psychological shift in the market. Lower trade friction often translates to better global growth prospects, which in turn boosts investor confidence and encourages allocations toward innovation and alternative assets. Crypto traders watch these macroeconomic cues closely, especially during periods of stagnant momentum.

Furthermore, China remains a crucial driver of global liquidity. A more stable relationship between Washington and Beijing could lead to stronger capital markets in Asia. Historically, positive sentiment in Asian markets has often correlated with stronger performance for Bitcoin, Ethereum, and other high-volume digital assets.

What Investors Will Be Watching

While optimism is growing, the market's reaction will hinge on the substance of the meeting, not just diplomatic pleasantries. Traders will be looking for specific signals of progress. Any concrete mention of renewed trade cooperation, adjustments to tariffs, coordination on technology sector policies, or commitments to economic stability would likely be interpreted as a bullish catalyst.

Crypto analysts note that even a neutral outcome, with no new negative surprises, would be supportive for the market. Investors have become accustomed to a tense environment, so the absence of new conflict can itself improve sentiment. The most positive reaction, however, would be reserved for clear statements pointing toward de-escalation in the ongoing trade disputes. Institutional investors will be closely monitoring currency markets, treasury yields, and equity futures for the first signs of how the meeting is being interpreted. Digital assets often react soon after these key indicators move.

Could This Spark the Next Crypto Rally?

Whether this single event can ignite a new bull run is a matter of debate. Some analysts believe the crypto market is primed for a catalyst and that an improvement in global relations could be the spark. Others remain more cautious, arguing that a sustainable rally requires a broader alignment of factors, including expanding liquidity, renewed ETF inflows, and predictable central bank policies.

The most probable scenario is a multi-stage reaction. A positive meeting could trigger a short-term relief rally, led by Bitcoin and other large-cap cryptocurrencies. If this aligns with favorable macroeconomic data in the following weeks, such as steady inflation or hints of future interest rate cuts, the rally could extend into a more durable trend. In any case, a cooperative meeting is widely seen as a net positive for the digital asset ecosystem.

As the meeting approaches, headlines will be watched with keen interest. While diplomatic events are not always market-moving, their impact can be swift and significant when they do deliver. With cryptocurrencies positioned at the forefront of the risk asset spectrum, even small shifts in global stability have the potential to reshape market momentum.